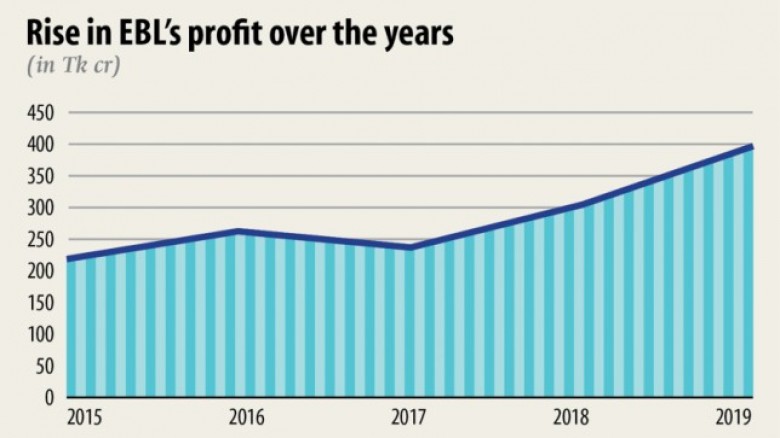

Eastern Bank’s profits rise on higher loan recovery, low NPL

The main reason of our profit rise in the challenging year was the higher recovery rate and we were able to keep the NPL ratio low," said Ali Reza Iftekhar, managing director and chief executive officer.

The lender recovered Tk 63.6 crore from its written-off loans last year which was Tk 42.3 crore and Tk 50.1 crore in 2018 and 2017 respectively. Meanwhile its recovery from classified loans were Tk 94.7 crore, Tk 70 crore and Tk 85.8 crore respectively.

Its non-performing loan (NPL) ratio was 3.35 per cent last year whereas the industry average was 9.32 per cent, according to its annual report.

"If the NPL remains high, profits are mostly hit with provisioning, from which we had relief as the quality of our assets is good and the NPL remains low," the CEO told The Daily Star yesterday.

Though the NPL ratio was low compared to others in the industry last year, it was higher than 2.35 per cent in 2018 which was preceded by 2.50 per cent, 2.69 per cent and 3.27 per cent in the past successive years.

This rise was mainly caused by a single account from the textile industry, according to the annual report.

Leave A Comment